Okay, buckle up buttercup! 2024 is shaping up to be a wild ride for the global economy, and it’s not all sunshine & rainbows. We’re talking serious geopolitical tensions, the kind that make even seasoned economists break out in a cold sweat. Think rising inflation, supply chain snafus, and energy prices that’ll make your eyes water. This isn’t some academic exercise, folks; it’s about real-world impacts on your wallet, your job, & your overall sense of financial well-being. So, what’s cooking in the geopolitical pressure cooker? Let’s dive in!

First up, the ever-present elephant in the room: the ongoing war in Ukraine. It’s not just a regional conflict anymore, it’s a global game-changer. The ripple effects are staggering – soaring energy costs, food shortages, and disrupted supply chains impacting everything from your morning coffee to the price of a new car. We’re seeing increased volatility in global markets, creating uncertainty & impacting investment decisions. This isn’t just bad news for businesses; it affects every single person, making budgeting more challenging than ever before.

Then there’s the ever-shifting sands of US-China relations. Tensions are simmering, creating friction across multiple fronts, from technology & trade to national security. The potential for further escalation is palpable, and this uncertainty fuels investor anxiety, potentially triggering market crashes & dampening economic growth. This is particularly impactful on the tech industry, manufacturing & global trade patterns generally . It’s a complicated relationship, to say the least, and its impact on the global economy is significant, creating instability & affecting consumer confidence. Do we dare hold our breath for a détente?

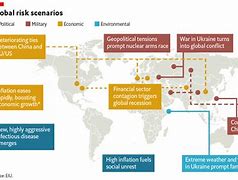

Beyond these major flashpoints, smaller conflicts & regional instabilities are adding fuel to the fire. Political unrest, economic sanctions, & resource scarcity are creating further disruptions – a perfect storm brewing on the horizon. Consider the impact of climate change as well – not a direct geopolitical conflict, but certainly a growing tension that fuels migration & resource competition, potentially adding to global instability & economic woes. It’s all interconnected, like a complicated Jenga game where one wrong move can trigger a collapse.

So, what’s the bottom line? Geopolitical tensions in 2024 & beyond pose a significant threat to global economic stability. We’re facing complex challenges that demand innovative solutions & international cooperation. The uncertainty is unsettling , but understanding these dynamics is crucial for navigating this turbulent landscape. Stay tuned for a deeper dive into specific sectors & regions to see how they’re individually affected , because we’re far from done unraveling this tangled web! This is just the tip of the iceberg , folks.

Related Post : The Global Energy Crisis: What’s Behind the Rising Energy Prices?

The Impact of Geopolitical Tensions on the Global Economy: A 2024 Forecast

The global economy in 2024 faces a complex and uncertain landscape, significantly shaped by escalating geopolitical tensions. Understanding these tensions and their potential impacts is crucial for businesses, governments, and investors alike.

What are Geopolitical Tensions? Understanding the Landscape in 2024

Defining Geopolitical Tensions: A Simple Explanation

Geopolitical tensions refer to the strained relationships and conflicts between nations, often involving disputes over territory, resources, ideology, or power. These tensions can manifest as diplomatic disagreements, trade wars, military actions, or cyberattacks, all capable of triggering significant economic consequences.

Key Players and Their Conflicts: Russia-Ukraine, US-China, and Beyond

The ongoing war in Ukraine, the increasingly strained relationship between the US and China, and other regional conflicts create a volatile global environment. These power dynamics significantly influence trade, investment, and global stability.

The Role of International Organizations: Can they mitigate geopolitical risks?

International organizations like the UN and WTO play a vital role in mediating disputes and promoting cooperation. However, their effectiveness in mitigating geopolitical risks is often limited by the conflicting interests of member states.

How Geopolitical Tensions Impact the Global Economy in 2024

Supply Chain Disruptions: The ripple effect of conflict

Geopolitical instability frequently disrupts global supply chains. Conflicts can lead to port closures, sanctions, and transportation bottlenecks, causing shortages and price increases for various goods.

Energy Markets and Volatility: Oil prices, gas shortages, and their economic consequences

The energy sector is particularly vulnerable. Conflicts and sanctions can drastically affect oil and gas prices, leading to inflation and impacting energy-intensive industries.

Inflation and its Global Reach: How geopolitical instability fuels rising prices

Geopolitical tensions are a major driver of inflation. Supply chain disruptions, energy price volatility, and uncertainty about future economic prospects all contribute to rising prices globally.

Food Security Concerns: The impact of war and sanctions on global food supplies

Major agricultural exporters involved in conflicts face disruptions in production and trade. Sanctions and export restrictions can exacerbate food shortages and price spikes, particularly in vulnerable regions.

Specific Geopolitical Events and their Economic Fallout in 2024

The War in Ukraine and its Economic Ramifications: A deeper dive

The war in Ukraine has triggered a significant energy crisis, disrupting food supplies, and causing massive refugee flows, impacting multiple economies.

US-China Relations and Trade Wars: Impact on global markets

The ongoing trade tensions between the US and China continue to affect global markets, impacting supply chains and technological development.

Other Emerging Conflicts and their Potential Economic Impacts

Various regional conflicts and political instability in different parts of the world also contribute to global economic uncertainty.

Industries Most Affected by Geopolitical Tensions in 2024

The Energy Sector: Navigating uncertainty and volatility

The energy sector faces significant challenges due to price volatility, supply disruptions, and the need for energy transition.

Manufacturing and Supply Chains: Adapting to disruptions and relocating production

Manufacturers are forced to adapt to supply chain disruptions, potentially relocating production to mitigate risks.

The Agricultural Sector: Food security, trade barriers, and price fluctuations

The agricultural sector faces challenges due to trade barriers, price fluctuations, and disruptions in food supply chains.

The Tech Industry: Geopolitical tensions and technological innovation

The tech industry faces challenges due to restrictions on technology exports and concerns about data security and intellectual property.

Mitigating the Risks: Strategies for Businesses and Governments

Diversification of Supply Chains: Reducing reliance on single sources

Businesses need to diversify their supply chains to reduce reliance on single sources and mitigate risks associated with geopolitical instability.

Investing in Renewable Energy: Reducing dependence on volatile fossil fuels

Investing in renewable energy sources reduces dependence on volatile fossil fuels and enhances energy security.

Strengthening International Cooperation: The importance of diplomacy and collaboration

Strengthening international cooperation and diplomacy is essential to de-escalate conflicts and foster stability.

Government Policies and Economic Resilience: Supporting businesses and vulnerable populations

Governments need to implement policies that support businesses and vulnerable populations during times of economic uncertainty.

Geopolitical Tensions, Global Economy, and 2024 Forecast: Predictions and Scenarios

Optimistic Scenarios: Potential for de-escalation and economic recovery

Optimistic scenarios suggest a potential de-escalation of conflicts and a subsequent economic recovery.

Pessimistic Scenarios: Continued conflict and prolonged economic instability

Pessimistic scenarios predict continued conflicts leading to prolonged economic instability and global recession.

Likely Scenarios: A balanced view considering current trends and potential risks

A balanced view suggests a continuation of geopolitical tensions, impacting global markets, but also a potential for measured responses and economic adaptation.

The Importance of Monitoring Geopolitical Developments: Staying informed for better decision-making

Continuous monitoring of geopolitical developments is crucial for informed decision-making by businesses, investors, and governments.

Investing in a Turbulent World: Strategies for navigating geopolitical risks

Diversification of Investment Portfolios: Reducing exposure to specific regions or sectors

Diversifying investment portfolios reduces exposure to specific regions or sectors affected by geopolitical instability.

Investing in Gold and other Safe Havens: Protecting capital during times of uncertainty

Investing in gold and other safe haven assets can help protect capital during times of uncertainty.

Analyzing Geopolitical Risks Before Investing: Due diligence is crucial

Thorough due diligence and geopolitical risk assessment are crucial before making investment decisions.

Conclusion: Preparing for a Future Shaped by Geopolitical Uncertainty

The global economy in 2024 and beyond will continue to be shaped by geopolitical uncertainties. Proactive strategies for risk mitigation, adaptation, and international cooperation are essential for navigating this complex landscape.